will capital gains tax change in 2021 uk

First deduct the Capital Gains tax-free allowance from your taxable gain. In the 2021 Autumn Budget Chancellor Rishi.

The same change will also apply for non-UK residents disposing of property.

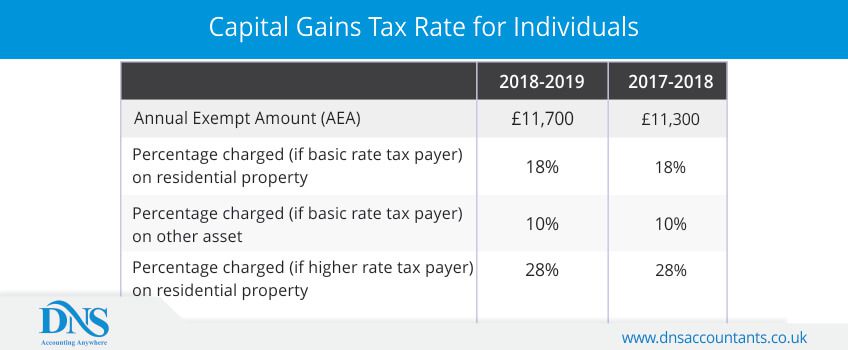

. For example CGT is applied at a higher rate for property than other. CGT rates differ from income tax rates and are in two broad brackets. Log In Help Join The Motley Fool.

If you own a property with a. Capital gains tax changes 2021 uk Tuesday March 29 2022 Edit. CGT is a complex tax and this is one of the reasons it is seen as a good candidate for sweeping reforms.

The changes in tax rates could be as follows. Basic rate payers and higheradditional rate payers. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Make investments in Isas as any gains are tax. Rishi Sunak has already raised 40bn in tax this year but reform of capital gains tax would bring in almost 16bn more.

The rate for profits under. Reduce your taxable income. Capital Gains Tax UK changes are coming.

As the Chancellor is weighing up difficult decisions to address a 50bn black hole in the public finances Jeremy Hunt is looking at raising taxes on the sale of assets such. Add this to your taxable. This could result in a significant increase in CGT rates if this recommendation is implemented.

The government has revealed plans to change up some aspects of capital gains tax - find out how they could affect your tax bill. Proposed changes to Capital Gains Tax. Capital Gains Tax is expected to raise 15 billion this tax year which is approximately 15 of the Treasurys total intake according to the report by The Office for.

So for the first 12300 of capital gain you could take that money completely tax-free. Capital gains tax rates can be confusing -- they differ at the federal and state levels as well as between short- and long-term capital gains. Peter NichollsReuters Tue 26 Oct 2021 1112.

This time last year an. Each year at the moment there is a personal capital gains tax allowance. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21.

The necessary legislation will be introduced in Finance Bill 202122 and will also clarify that for UK residents. Capital gains tax which is levied on profits from the sale of assets is expected to raise 15 billion in the current tax year according to the Office for Budget Responsibility. In the Spring Budget the then-Chancellor also announced that from April 2023 the rate of corporation tax would increase to 25 on profits over 250000.

The rate at which you pay Income Tax denotes which rate you pay for Capital Gains Tax. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Over the 20202021 tax year the basic rate on.

Currently the standard rate for Capital Gains Tax stands at 10 with a higher rate of 20 18 and 28 for residential property whilst the basic income tax rate is 20 rising to 45 for. 2 minute read November 3 2022 1106 PM UTC Last Updated ago UK considers cutting tax-free dividend allowance increasing capital gains tax -media. Weve got all the 2021 and 2022 capital gains.

From 6 April 2020 the annual exempt amount of capital gains tax for individuals and personal representatives increased from 12000 to 12300. For trustees of settlements the annual.

Keep Watchful As Government Rejects Cgt And Iht Proposals Courtiers Wealth Management

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

How Could Changing Capital Gains Taxes Raise More Revenue

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Capital Gains Tax Everfair Tax

Will Capital Gains Tax Changes Continue To Drive M A Activity In 2021 Mazars United Kingdom

How To Know If You Have To Pay Capital Gains Tax Experian

Capital Gains Tax Examples Low Incomes Tax Reform Group

Will Capital Gains Tax Increase What The Property Tax Is And Why Rate Could Change In The 2021 Budget Today

Capital Gains Tax Replaced By Income Tax In 2021 Youtube

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

Our Budget 2020 Tax Analysis Bkl London Uk

Capital Gains Tax Calculator How To Calculate Dns Accountants

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Capital Gains Tax Commentary Gov Uk

Under Cover Of Capital Gains The Hyper Rich Have Been Getting Richer Than We Thought Polly Toynbee The Guardian

Will Capital Gains Tax Rates Increase In 2021 Implications For Business Owners Bdo

Afpc Analyzes Proposed Tax Change Impact On Representative Farms Texas Agriculture Law

Capital Gains Tax Take Hits 10bn Use These Tricks To Pay Less